Ocean cargo insurance coverage is a great tool that you can use to protect your goods when you send them overseas. There are so many factors that are at play when freight is being shipped to another country. As a result, the possibility of your freight becoming damaged or lost while in transit is a very real possibility.

Ocean cargo insurance coverage can protect against damage or loss caused by weather events, piracy, loss and many other dangers. You can obtain two types of ocean cargo insurance which are called all risk and named perils insurance. Ocean cargo insurance usually costs 0.5 percent of your total cargo.

Ocean cargo insurance coverage is highly recommended for international shipments due to the benefits it offers shippers.

Ocean cargo insurance coverage is a broad term used to describe the policy that exporters and importers use to protect their international shipments. Also called marine insurance and sea insurance, this type of insurance will compensate shippers if their goods sustain loss or damage.

The fundamental principles of cargo insurance are pretty similar to other forms of insurance. Based on the terms of the sale, the shipper pays the premium of the insurance policy. In the event that something happens to the cargo, the affected parties are compensated for the loss or damages.

Our article discussing cargo insurance will give you the basics of this important service.

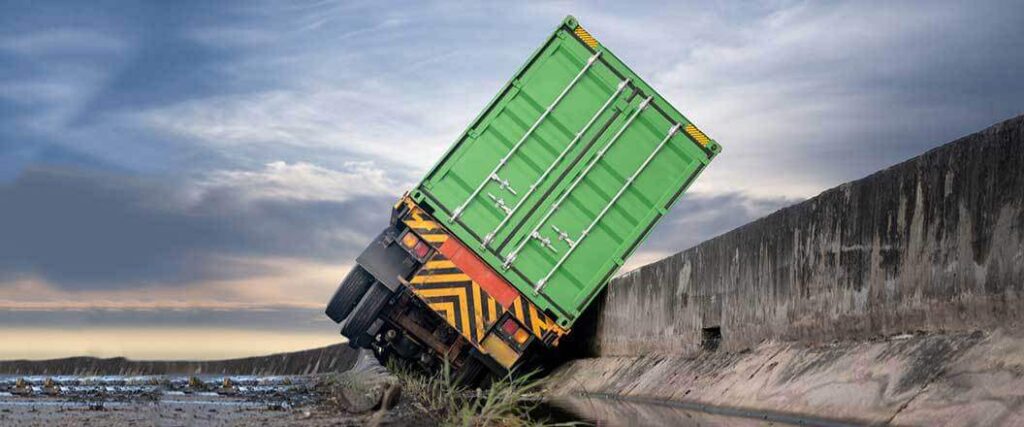

As we mentioned before, there are many opportunities for your freight to sustain damage or become lost when using international ocean freight shipping. These causes are typically associated with ocean shipping only.

One common cause of damage or loss that marine insurance covers are weather events. When a weather event occurs on the ocean seas, it’s often much more devastating than it would be if it was occurring on land. Some weather events that could wreak havoc on your goods are:

Hurricanes and tropical storms are tracked by various weather stations which makes it easy for cargo ships to avoid large storms like these. However, there’s always the chance that a cargo ship could get caught in a smaller storm. These types of storms can form fast and with little warning.

They can also create strong waves that rock cargo ships, causing cargo containers to fall over into the ocean.

Another factor that could cause the loss or damage of goods is piracy. Many shippers might think that piracy is something of the past, or at the most, not a common occurrence. However, modern piracy is thriving and it’s possible that your goods could be illegally seized.

According to the International Chamber of Commerce’s (ICC) Commercial Crime Services (CCS), there were 195 incidents of piracy. Numbers like these are why you should take incidents of piracy seriously when you’re preparing an international shipment.

Protect your freight from being stolen by using our article on cargo theft prevention.

While every effort is made to keep freight secure and packed safely when it’s within a cargo container, there’s still the possibility that the freight within can shift due to honest accidents. When freight shifts within a container, any of the following could happen:

Freight can shift during the importing and exporting process for various reasons as well. Some of them include:

Any of the scenarios that we’ve discussed could cause your freight to sustain some degree of damage or loss. Our article on the benefits of cargo insurance will go more in-depth on why you should protect your goods.

There are many policies that an insurance company can offer for international shipments of freight. This gives importers and exporters alike the ability to choose a type of marine insurance coverage that works best for the needs of their shipment.

There are many types of marine insurance, but not all of them are specifically for shippers. Some insurance policies are actually designed for owners of cargo vessels. For the purposes of this article, we’ll discuss insurance policies meant explicitly for shippers.

As the name implies, all risk insurance coverage includes protection from losses and damages that are from external causes. This form of insurance protection is commonly used by importers and exporters conducting international trade due to its comprehensive coverage.

On top of the comprehensive coverage offered by all risk insurance, you’ll also have access to a variety of other perks when you use this insurance policy. These include:

Whether you’re selling goods and shipping them off or buying them and bringing them into the United States, all risk insurance coverage gives you protection from a wide variety of scenarios. However, there are a few scenarios that all risk insurance won’t be able to give you protection from. Fortunately, some of the scenarios that all risk insurance doesn’t cover can be avoided.

Scenarios not covered by all risk insurance include:

Essentially, all risk insurance policies will cover anything unless explicitly stated otherwise, such as what we listed above. All risk insurance is a great policy to use but isn’t your only option when you ship goods via ocean freight. Our article on all risk cargo insurance will provide you with more details on this useful policy.

The second insurance option that you can choose is named perils insurance. This form of insurance policy will only protect your goods from specific types of damage and loss stated in the policy itself. Rather than offering a comprehensive amount of protection, named perils offer a narrower level of protection instead.

Some types of loss and damage that might be explicitly stated in a named perils policy are:

If you know the specific risks that your shipment will face when shipping it to another country, it might make more sense to use a named perils insurance policy. That way, you’re only paying for a policy that will protect you from dangers that are more likely to occur rather than paying for a policy that protects you from everything.

Both of these types of ocean cargo insurance coverage are applicable for both land and air transportation as well. If you need protection for refrigerated goods, check out our article on reefer cargo insurance.

Something else that might cost you a considerable amount of money when using ocean freight shipping, even if you’re goods aren’t lost or damaged, is general average. In maritime law, general average is a principle that essentially states that all stakeholders (usually the shippers and vessel owner) in an ocean shipment have entered a business venture together.

As part of the business venture, stakeholders share the loss and damages that take place due to an intentional sacrifice of freight during an ocean voyage. The term “jettison” describes an intentional sacrifice of freight during an ocean voyage.

Some reasons that freight might be jettisoned from a cargo ship include the following:

The costs that shippers can incur when their freight is jettisoned like in the examples above are quite frustrating. Fortunately, ocean cargo insurance can protect you from incidents like these. We stated earlier that all risk insurance gives you general average protection. Named perils insurance can as well if it’s explicitly mentioned in the policy.

Fortunately, the rates for ocean cargo insurance aren’t too expensive. The premium you pay for cargo insurance on your ocean freight will be around 0.5 percent of the total value of your freight. Based on your insurance provider and the policy that you’ve chosen, this amount can go up or down.

This fluctuation means you can spend anywhere between $75 to $150 to protect your freight. We’ve provided a few examples below to show you how much this small amount of money will give you coverage for costly freight shipments in the table below.

| Value Of Cargo | $15,000 | $15,000 | $15,000 |

| Deduction | 0.5% | 0.7% | 1% |

| Total Cost Of Insurance | $75 | $105 | $150 |

The examples we’ve given clearly show that even expensive shipments like these can be cheaply protected from the dangers of shipping on the high seas.

Another type of insurance that has “marine” in it is marine inland insurance. Unsurprisingly, the name of this type of ocean cargo insurance confuses many shippers. Fortunately, these two insurance policies are starkly different in regard to what type of goods they’re meant to protect.

Simply put, inland marine insurance will protect your goods while they’re being transported overland using the following shipping methods:

Regulate marine insurance (aka sea insurance and ocean cargo insurance) is used when transporting freight overseas. Both forms of insurance can protect freight from damages or loss, but inland marine insurance protects shipments from damages and loss that is more likely to occur due to ground shipping.

Our article on CIF insurance will show you how this payment term can help protect your shipments.

All shipments booked with Freight Insurance Coverage are automatically covered by insurance. When you fill out one of our quotes, the cost of insurance is factored into the total cost of your shipment. This means you won’t have to worry about adding in the costs of insurance on your own.

If you’re ready to ship freight with the protection of ocean cargo insurance coverage then fill out your quote below or call us at (866) 975-0749.

Freight Insurance Coverage

315 NE 14th Street #4122

Ocala, FL 34470